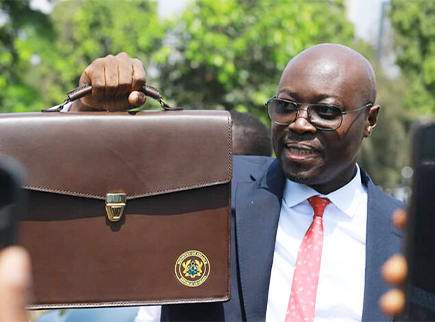

Dr. Cassiel Ato Baah Forson will present a review of the 2025 budget before Parliament today, July 24, 2025, providing an assessment of the performance of the economy for the first half of the year.

The Constitutional duty is being delivered with high expectations of businesses and Ghanaians about measures to sustain the stability in macroeconomic indicators since the beginning of the year.

Section 28 of the Public Financial Management Act, 2016 (Act 921), mandates the Minister of Finance to update Parliament on the execution of the national budget and provide an outlook for the rest of the fiscal year.

The review will cover updates on revenue generation, expenditure, debt management, and the progress of key government projects for first half of 2025 as well as economic outlook for the rest of the year.

It will also feature the status of the ongoing three-year US$3 billion International Monetary Fund (IMF) loan-supported programme, which has so far seen a total disbursement of US$2.4bn to support Ghana’s economic recovery and stability efforts.

This mid-year review is considered crucial as it will inform the public and stakeholders about the government’s economic strategy and any necessary adjustments to the budget based on the first half’s performance.

Already, the country has a steady decline in inflation from 23.5 per cent in January to 13.7 per cent as of May 2025, appreciation of the Cedi, and a Gross Domestic Product (GDP) growth of 5.3 per cent in the first quarter.

Despite these strong performances, there are calls for sustainability to enable business to plan with associated effects on expansion, job creation and economic growth – which the budget review is anticipated to address.

Commenting on the signs of stabilisation, Dr. Johnson Pandit Asiama, Governor of the Bank of Ghana (BoG), noted significant risk to the country’s macroeconomic conditions, calling for prudent collaborative efforts to mitigate the risks.

On inflationary vulnerabilities, Dr. Asiama cited constraints on food supply, especially from northern Ghana and the Sahel, and external price shocks in the face of volatility in global commodity markets.

He also cited geopolitical tensions and evolving global trade dynamics, including recent US-led tariff disputes, as developments that had increased market uncertainty, raising concerns of their effects on commodity prices, exchange rate, and financial flows to emerging countries, including Ghana.

The Chief Executive Officer (CEO) of the Ghana Association of Banks, Mr. John Awuah, has described the recent cooling inflation and stabilising exchange rate as “encouraging,” urging the government to sustain it over six months to a year.

That, together with a cut in the Monetary Policy Rate, he said would be crucial in banks’ providing affordable loans to businesses and individuals to further stimulate economic activities.

“The signals are encouraging. We believe the economy is ripe for a reduction in the policy rate by at least 200 basis points, which will translate into more competitive lending rates across the commercial banking sector.”

Dr. Joseph Obeng, President, Ghana Union of Traders Association (GUTA), earlier told the Ghana News Agency that a stable macroeconomy would speed up business recovery, and gains transferred through reduction in prices, making the consumer enjoy some respite.

He echoed the need for the government to review the Value Added Tax (VAT) and port charges to create a business-friendly environment in addition to retention policies to control repatriation of profits.

Mr. Seth Twum-Akwaboah, CEO, Association of Ghana Industries (AGI), also said, “It’s important for the environment to be conducive by stabilising the macroeconomy, so that when you invest, you get good returns, and be able to expand.”

The IMF in the fourth review observed that Ghana is advancing in its comprehensive reform strategy, which has been aligned with the 24-hour economy policy and the “Big Push” infrastructure programme.

It also noted that the economic outlook remained generally positive although growth was set to decline this year due to a large negative fiscal impulse, monetary tightening, the likelihood of external environment deterioration and slippages.

The IMF urged authorities to preserve the integrity of the fiscal policy adjustment under the Extended Credit Facility (ECF) programme to fully restore macroeconomic stability and debt sustainability, while protecting the vulnerable.

Categories

Editor's Pick

Finance Minister presents mid-year budget review amidst high stability expectations